Creating a budget is a simple way to make sure you stay on track with your finances. It’s a helpful tool to make sure you are making all payments necessary every month, including fixed expenses such as payments for rent/mortgage, car loans, title loans, credit cards, and insurance, as well as more variable expenses such as transportation, electricity and phone bills. Here are some very basic steps to budget for yourself and your family.

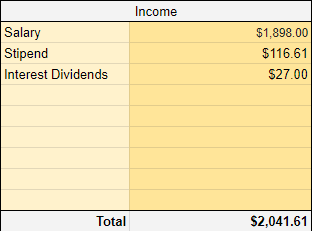

Step One: Add Up All Sources of Income

This step is usually very simple, as most people only have one source of income, but if you get income from more than one source, such as form a student stipend or investment income, include it in this area of the spreadsheet. Here is an example:

It is important to put your net income here, as that is what is important to your budget. Net income that you can’t spend can’t go towards expenses, so it shouldn’t be added to your budget.

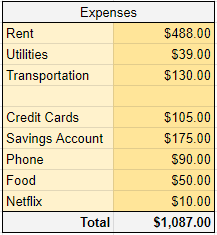

Step Two: Calculate and Track All of Your Monthly and Quarterly Expenses

The first step to creating a successful budget is knowing all of your bills, expenses and costs, and whether they are the same each month, or they fluctuate.

Fixed expenses, or expenses that are the same each month, are things like your rent, where the amount due each month is the same.

Variable expenses are costs that aren’t fixed and can change month to month, like the amount you spend on gas for your car or food for yourself and your family.

Fixed expenses are the easy part, so get those down first. Add all of your expenses liny by line to a spreadsheet and add them up. It should look something like this:

These are all things that you must pay every month, but it is a good idea to include expenses such as “discretionary spending” where you take a variable expense and allocate a specific amount for it every month that you don’t exceed. This can also be done with transportation as long as you spend about the same every month. Car insurance is fixed, but gas isn’t, however if you drive the same route to work every day and have very set routines, you’ll probably use about the same amount every month. This is a way of treating a variable expense as a fixed expense.

Once fixed expenses are accounted for, it is time to add in variable expenses. If you go out to eat often, or even just a few times a month, you need to budget for how much you are spending on that every month. This can be difficult, as it changes every month, but you can budget for this by either averaging out what you’ve spent in previous months. You can also inflate the estimated costs as well a bit to give a little breathing room in case you go over budget.

Step Three: Budget for Savings

You’ve already included debt repayment in your fixed expenses, as well as all the money that you pay everyone else, but it is important to pay yourself too, or future you in the case of savings. Some recommend saving 20% of total net income for savings, but this isn’t attainable for many. However, you should always designate a set amount every month to go towards savings. You’ve worked hard for your money, so why not keep some of it. To do this, simply subtract all of your expenses from your income and whatever is left is money that can be put towards savings!

It’s That Easy

These three easy steps have set you up for a strong financial foundation. There are more complex methods out there, but if you don’t have a budget at all, start with this to make it a great, helpful habit and develop your savings skills. Track your expenses and spending every month and make sure you’re not going over budget, and if you are going over budget every month, either adjust your spending or adjust your budget.

Comments are closed.